Why SPL Tokens and Yield Farming on Solana Deserve Your Attention (Especially via Mobile)

Okay, so check this out—when I first dipped my toes into the Solana ecosystem, I was mostly skeptical. SPL tokens? Yield farming on a blockchain that promises lightning-fast transactions? Seriously? My gut said, « Sounds too good to be true, » but curiosity got the better of me.

Here’s the thing. Using SPL tokens feels different than your typical ERC-20 experience on Ethereum. The network’s design makes everything way snappier, which is crucial when you’re juggling a bunch of yield farming positions, often on mobile. Yeah, mobile apps for crypto can be clunky, but Solana’s ecosystem has been stepping up.

At first, I just wanted to stake some tokens and see what the fuss was about. But then I realized that managing SPL tokens and yield farming strategies on the go requires a secure, intuitive wallet. It’s not just about convenience; it’s about safety and control.

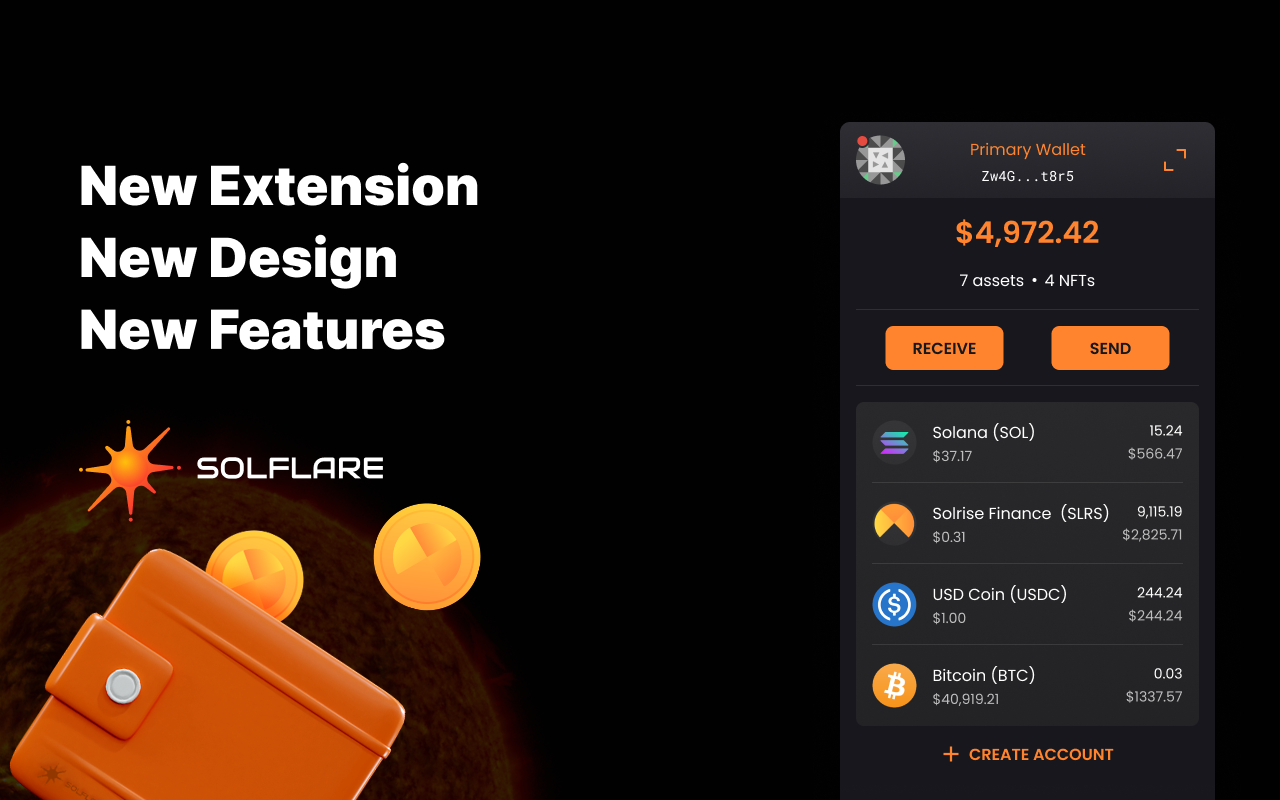

Whoa! Have you tried using a wallet that feels like a maze? Frustrating, right? That’s why I’ve been leaning heavily on the solflare extension. It’s a game-changer for managing SPL tokens seamlessly, whether you’re on your desktop or need quick access through mobile.

Honestly, there’s a lot to unpack here. The way Solana’s architecture handles tokens and DeFi is unlike what you get elsewhere, and that affects everything from transaction fees to staking rewards. But more on that in a bit.

The Real Deal with SPL Tokens—Not Your Average Crypto

SPL tokens are basically Solana’s version of ERC-20s, but with a twist. They’re designed to be super lightweight, which means transactions cost pennies instead of dollars. Really, it’s like the difference between mailing a postcard and a full package every time you move tokens around.

My first impression was that this would be just another altcoin token standard, but nope—SPL tokens are optimized for speed and efficiency. That opens up interesting possibilities for yield farming, which thrives on quick, low-cost transactions.

Here’s what bugs me about some other token standards: they can get clogged up easily. Solana’s network feels like a freeway with minimal traffic, letting you hop in and out of liquidity pools without the usual headaches.

Initially, I thought yield farming here would be complicated, but the ecosystem’s tooling, especially wallets that support SPL tokens, makes it manageable—even for someone who’s not a full-time dev.

Though, I’ll admit, the learning curve is still there. Managing multiple farms and staking positions can get confusing fast if you don’t have the right interface. This is where the wallet choice really matters.

Mobile Apps: The Unsung Heroes of Solana DeFi

Mobile apps for crypto wallets often feel like an afterthought. But with Solana, the story is shifting. Using mobile to track SPL tokens and yield farming positions isn’t just about flexibility—it’s about reacting quickly to market moves.

Seriously, sometimes a 10-minute delay can mean missing out on a sweet yield farming opportunity—or worse, losing out on rewards because you forgot to claim them.

My instinct told me I needed a wallet that could keep up without draining my battery or confusing me with too many options. The solflare extension fits that bill nicely, especially since it syncs well with mobile setups and offers a clean UI.

One small gripe, though: not all mobile apps handle complex DeFi actions smoothly. Some wallets struggle with staking interfaces or show delayed balances, which is a dealbreaker for active yield farmers.

On one hand, this ecosystem is young and evolving rapidly; on the other, that means you have to be a bit tech-savvy or willing to learn on the fly.

Yield Farming on Solana: Fast, Cheap, but Watch Your Steps

Yield farming is often painted as a get-rich-quick scheme, but in reality, it’s a nuanced game. With Solana’s near-instant transactions and low fees, the barriers to entry are lower, which is great. But that also means more people jump in without fully understanding risks.

Something felt off when I saw farms promising insane APYs—too good to last, or maybe just very very risky. The key is knowing which SPL tokens and protocols are trustworthy.

Personally, I limit my exposure to pools with solid liquidity and transparent teams. The wallet you use, again, plays a crucial role here—being able to monitor your positions easily and get alerts makes all the difference.

Actually, wait—let me rephrase that. It’s not just about monitoring but also about interacting quickly. When the market shifts, you gotta move fast. The solflare extension helps by streamlining these transactions without the usual gas fee nightmares found on other chains.

Though, a quick heads-up: yield farming can be a bit like fishing in a fast river—you gotta keep your wits about you or risk losing your bait.

Final Thoughts: Is This the Future or Just Hype?

So here’s the bottom line: SPL tokens, mobile wallets, and yield farming on Solana create a compelling combo that’s hard to ignore if you’re into DeFi. The speed and cost advantages are real, and the tooling is improving quickly.

But I’ll be honest, it’s not for everyone yet. The ecosystem is still ironing out kinks, and the learning curve isn’t trivial. If you’re willing to dive in, though, having a reliable wallet like the solflare extension can make the ride a lot smoother.

Initially, I thought this was just another crypto fad, but now I see it as an intriguing piece of the puzzle for practical DeFi use. There are still unanswered questions and risks, but hey, that’s the crypto world for ya—fast-moving and a little wild.

Hmm… I guess I’m cautiously optimistic. If you’re curious, give it a shot—but don’t go in blind. And if you’re managing SPL tokens or yield farming on mobile, trust me, pick your tools wisely.